Your money with a 'Fixed Deposit' Grow Secure Save Earn

Benefits of Fixed Deposit (FD):

- Guaranteed returns: Fixed deposits offer guaranteed returns, which means that you know how much money you will earn on your investment. This makes them a good option for people who are looking for a safe and secure investment.

- Liquidity: Fixed deposits are relatively liquid, which means that you can easily access your money if you need it. However, there may be penalties for early withdrawal.

- Flexibility of tenure: Fixed deposits offer a variety of tenure options, ranging from a few months to 10 years. This allows you to choose an FD that fits your investment horizon and risk appetite.

- Tax benefits: Fixed deposits offer tax benefits under Section 80C of the Income Tax Act. This means that you can deduct up to INR 1,50,000 of your investment in a fixed deposit from your taxable income.

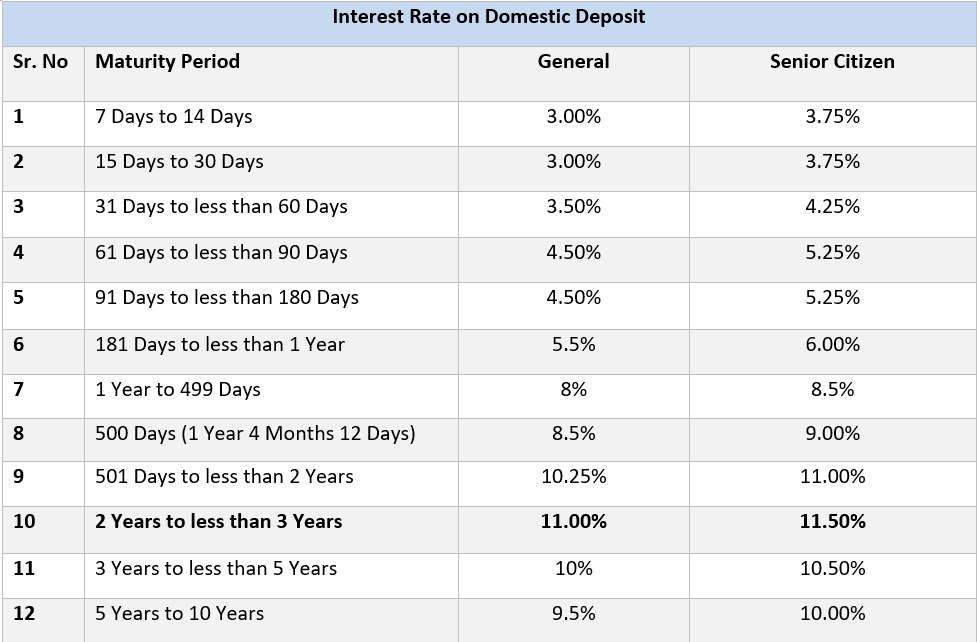

- Senior citizen benefits: Senior citizens are eligible for additional interest on fixed deposits. This is usually 0.50% higher than the interest rate offered to regular investors.

Fixed deposits are a good option for people who are looking for a safe and secure investment with guaranteed returns. They are also a good option for people who want to save for a specific goal, such as a house down payment or retirement.

However, it is important to note that fixed deposits offer lower returns than some other investment options, such as stocks or mutual funds. So, if you are looking for higher returns, you may want to consider other investment options.

Here are some of the risks associated with fixed deposits:

- Interest rate risk: The interest rate on fixed deposits is fixed for the tenure of the deposit. So, if interest rates go up after you have invested, you will not benefit from the higher rates.

- Inflation risk: Inflation is the rate at which prices increase over time. If inflation is high, the real value of your investment will go down.

- Liquidity risk: Fixed deposits are relatively liquid, but there may be penalties for early withdrawal.

It is important to weigh the benefits and risks of fixed deposits before investing. If you are looking for a safe and secure investment with guaranteed returns, fixed deposits can be a good option for you. However, if you are looking for higher returns or more liquidity, you may want to consider other investment options.